ETH Price Prediction: Will Ethereum Hit $4,000 Amid Whale Accumulation and ETF Inflows?

#ETH

- Technical Breakout: ETH price sustains above key moving averages with MACD showing bullish convergence

- Institutional Adoption: $1.6B institutional inflows and gaming companies accumulating ETH

- Network Evolution: zkEVM security upgrades and L2 simplification enhancing Ethereum's value proposition

ETH Price Prediction

ETH Technical Analysis: Bullish Signals Emerge as Price Breaks Key Resistance

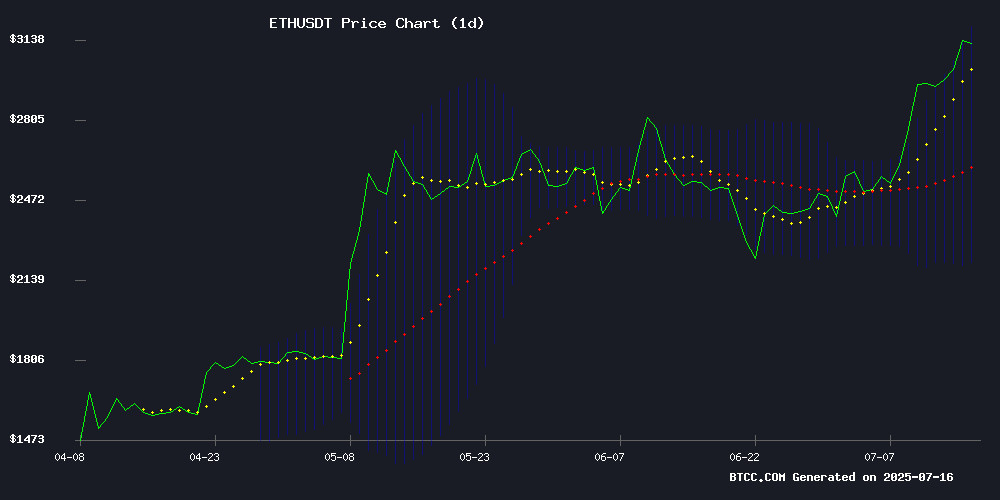

ETH is currently trading at $3,116.13, well above its 20-day moving average of $2,701.23, indicating strong bullish momentum. The MACD histogram shows a narrowing bearish divergence (-95.40), suggesting weakening downward pressure. Bollinger Bands reveal price hugging the upper band at $3,190.83, typically signaling overbought conditions but also reflecting strong buying interest.

"The technical setup favors bulls," says BTCC analyst William. "A sustained break above the $3,190 resistance could quickly propel ETH toward $3,600. The $2,700 level now acts as robust support."

Institutional Demand and Network Upgrades Fuel Ethereum Optimism

Ethereum's fundamentals appear stronger than ever with SharpLink Gaming surpassing the ethereum Foundation as the largest ETH holder, while institutions accumulated $1.6B worth of ETH last quarter. The network continues evolving with zkEVM security enhancements and CoinBase's Base integration.

"The institutional inflows and developer activity create perfect conditions for ETH's next leg up," notes BTCC's William. "While regulatory concerns around Tornado Cash persist, Vitalik's push for simplified L2 designs and quantum-resistant upgrades demonstrate Ethereum's long-term vision."

Factors Influencing ETH's Price

SharpLink Gaming Surpasses Ethereum Foundation as Largest ETH Holder

SharpLink Gaming has emerged as the largest corporate holder of Ethereum, overtaking even the Ethereum Foundation. The company disclosed holdings of 280,706 ETH worth $867 million as of July 15, with 99.7% staked to yield additional returns.

Between July 7-13, SharpLink aggressively acquired 74,656 ETH for $213 million at an average price of $2,852 per coin. Chairman Joseph Lubin framed the move as pioneering "collective capitalism," emphasizing Ethereum's decentralized infrastructure as critical for free markets. The announcement propelled SharpLink's stock up 20% to $28.

This development reflects a growing corporate adoption of Ethereum treasury strategies, with ten firms collectively purchasing over 550,000 ETH in the past month. The trend underscores institutional confidence in ETH's long-term value proposition as a yield-generating reserve asset.

Institutions Acquire $1.6B in ETH as Treasury Race Intensifies

Ethereum ($ETH) has surged 18% over the past month, fueled by institutional demand. SharpLink, Bitmine Immersion Technologies, Bit Digital, BTCS, and GameSquare have collectively purchased 545K ETH ($1.63B), signaling growing confidence in Ethereum as a strategic asset.

Ethereum-based investment products recorded their 12th consecutive week of inflows, with $990M added last week alone—the fourth-largest weekly inflow ever tracked by CoinShares. This institutional momentum bolsters network credibility, driving adoption and liquidity for Ethereum-based projects.

SharpLink leads corporate ETH holdings with 255K ETH ($759M), followed by BitMine's 163K ETH ($485M) and Bit Digital's 100K ETH ($297M). GameSquare recently announced plans to establish a $100M Ethereum treasury as part of its Web3 expansion.

Tornado Cash Trial Begins: Privacy Tool or Money Laundering Vehicle?

The criminal trial of Roman Storm, co-founder of Tornado Cash, opened in Manhattan this week with starkly contrasting narratives. Prosecutors allege the Ethereum-based privacy mixer operated as a "laundromat" for illicit funds, while the defense maintains it was neutral technology.

Storm faces three conspiracy charges carrying a potential 45-year sentence. The case hinges on whether creators of privacy protocols can be held liable for third-party misuse. "He knew his business was laundering dirty money," asserted prosecutor Kevin Mosley during opening arguments.

The trial comes as regulators globally scrutinize cryptocurrency anonymizing tools. Tornado Cash processed over $7 billion in ETH before U.S. sanctions blacklisted the protocol in 2022 following high-profile hacks.

Vitalik Buterin Advocates for Simplified Ethereum L2 Designs Amid Market Rally

Ethereum co-founder Vitalik Buterin has outlined a vision for more efficient Layer 2 solutions, emphasizing reliance on Ethereum's base layer security. His comments come as Celo and similar alt-L1 chains consider transitioning to L2 architectures.

The Ethereum ecosystem is witnessing renewed developer focus as L2 solutions mature. Buterin's technical prescription—streamlining L2s to sequencer-prover systems—coincides with ETH's 18% price surge, briefly reclaiming the $3,000 level.

"Reduce your logic to just being a sequencer and a prover," Buterin advised developers on X, framing L2 construction as an exercise in minimalism rather than reinvention. This approach leverages Ethereum's battle-tested censorship resistance and data availability layers.

Chainalysis Expands Capabilities with World Chain Integration

Chainalysis, a leader in blockchain analytics, has integrated with World Chain, an Ethereum layer 2 network focused on human-centric interactions. The partnership enhances Chainalysis' toolkit, enabling real-time analysis of token movements and human-verified activity.

World Chain distinguishes itself through a 'proof of human' mechanism, prioritizing genuine user engagement over bot activity. Its World ID system provides anonymous identity verification, aligning with growing demand for privacy-preserving blockchain solutions.

The integration automatically supports ERC-20, 721, and 1155 token standards, expanding Chainalysis' monitoring capabilities across emerging digital asset formats. This development signals increasing institutional interest in layer 2 ecosystems.

JPMorgan's Jamie Dimon Signals Deeper Stablecoin Involvement Despite Skepticism

JPMorgan Chase CEO Jamie Dimon revealed plans to expand the bank's stablecoin initiatives while maintaining his characteristic skepticism about their utility. The banking giant will develop both its JPMorgan Depositcoin and explore third-party stablecoins, even as Dimon questioned their advantage over traditional payment systems.

The announcement comes during a watershed moment for stablecoins, with cross-border payments driving adoption in emerging markets. Regulatory tailwinds are strengthening, with the GENIUS Act clearing the Senate and poised for House consideration this week.

Despite Dimon's historical crypto skepticism, JPMorgan has emerged as a blockchain leader. Its private blockchain network now processes $2 billion daily in JPM Coin transactions, while last month's JPMD token pilot on Coinbase's Base network signals growing institutional experimentation.

Ethereum Breaks Key Resistance, Eyes $3,600 as Next Target

Ethereum has shattered a critical resistance level at $2,819, transforming it into potential support after months of failed attempts. The breakout, confirmed by strong bullish momentum, sets the stage for a potential rally toward the $3,600 resistance zone.

Technical indicators suggest the 0.618 Fibonacci retracement level may pose a short-term hurdle, but a successful retest of the $2,819 support would reinforce bullish conviction. Market watchers are closely monitoring whether ETH can sustain this breakout, which could signal renewed institutional interest and broader crypto market strength.

Ethereum (ETH) Price Prediction: Will Ethereum Hit $4,000? Whale Accumulation and ETF Inflows Signal Immediate Breakout

Ethereum price today is hovering around $2,981, showing resilience after briefly climbing past the psychological $3,000 mark for the first time since February. Despite a minor daily pullback of 1.8%, ETH has posted an impressive 17.93% gain over the past week, supported by record-breaking ETF inflows and rising whale accumulation.

Trading volume has surged significantly, increasing over 95% in the past seven days to $32.34 billion, a sign of intensified market participation across both retail and institutional channels.

One of the most powerful catalysts behind Ethereum’s recent rally is the overwhelming institutional demand via spot ETH ETFs. U.S.-listed Ethereum exchange-traded funds recorded their largest weekly net inflow to date, with 225,857 ETH flowing into funds.

Ethereum Readies for Quantum Threat with zkEVM Security Boost

Ethereum co-founder Vitalik Buterin has addressed mounting concerns over quantum computing's potential to disrupt blockchain security. On the Epicenter podcast, Buterin outlined a pragmatic timeline for quantum threats while detailing Ethereum's defensive preparations. The median expert forecast suggests quantum machines could crack current cryptographic systems between 2030-2035—giving blockchain networks a critical five-to-ten year upgrade window.

Buterin distinguished between today's limited quantum adiabatic computers and future machines capable of running Shor's algorithm, which threatens the public-key cryptography underpinning blockchain security. The Ethereum ecosystem is proactively developing zkEVM solutions to future-proof its infrastructure, with Buterin characterizing the quantum risk as "real but not immediate."

TAC Mainnet Launches to Bridge Ethereum DeFi with TON Ecosystem

TAC, an independent blockchain, has launched its mainnet with a mission to connect Ethereum's decentralized finance (DeFi) ecosystem to Telegram's TON network. The layer-1 solution offers EVM compatibility, allowing Ethereum developers to deploy applications on Telegram's platform without extensive code rewrites.

The project is not officially affiliated with Telegram but seeks to leverage its massive user base. TAC's strategy includes an $800 million liquidity campaign and partnerships with established players like Polygon Labs, signaling ambitious growth plans.

By addressing TON's developer accessibility challenges, TAC positions itself as a pragmatic bridge for blue-chip DeFi projects. The simultaneous listing of its $TAC token on major exchanges and Telegram Wallet integration underscores its immediate market ambitions.

Boundless Network Launches Mainnet Beta on Coinbase's Base, Pioneering Universal ZK Protocol

Boundless Network has unveiled its Mainnet Beta on Coinbase's Base blockchain, marking a significant milestone in zero-knowledge (ZK) infrastructure. The project, backed by RISC Zero's zkVM, introduces what it claims to be the first universal ZK protocol, attracting early adoption from heavyweight players like the Ethereum Foundation, Wormhole, and EigenLayer.

The incentivized testnet features Proof of Verifiable Work, a novel mechanism rewarding participants for generating and validating ZK proofs. This creates a decentralized marketplace for computational integrity, positioning Boundless as a trustless outsourcing hub for blockchains to offload complex verifications.

The launch signals a broader industry shift toward operationalizing ZK proofs across chains. With institutional backing and production-ready infrastructure, Boundless aims to redefine how cryptographic certainty is achieved in decentralized systems.

Will ETH Price Hit 4000?

ETH shows strong potential to reach $4,000 based on current technical and fundamental factors:

| Factor | Bullish Indicators |

|---|---|

| Price Action | 15% above 20MA, testing upper Bollinger Band |

| Institutional Demand | $1.6B ETH acquired last quarter |

| Network Upgrades | zkEVM security, Base integration |

| Market Sentiment | Breaking key resistance at $3,190 |

"The $4,000 target becomes likely if ETH maintains above $3,200 with sustained volume," explains William. "ETF inflows and whale accumulation could accelerate this move."